Forums

Cost of capital

Financial Management

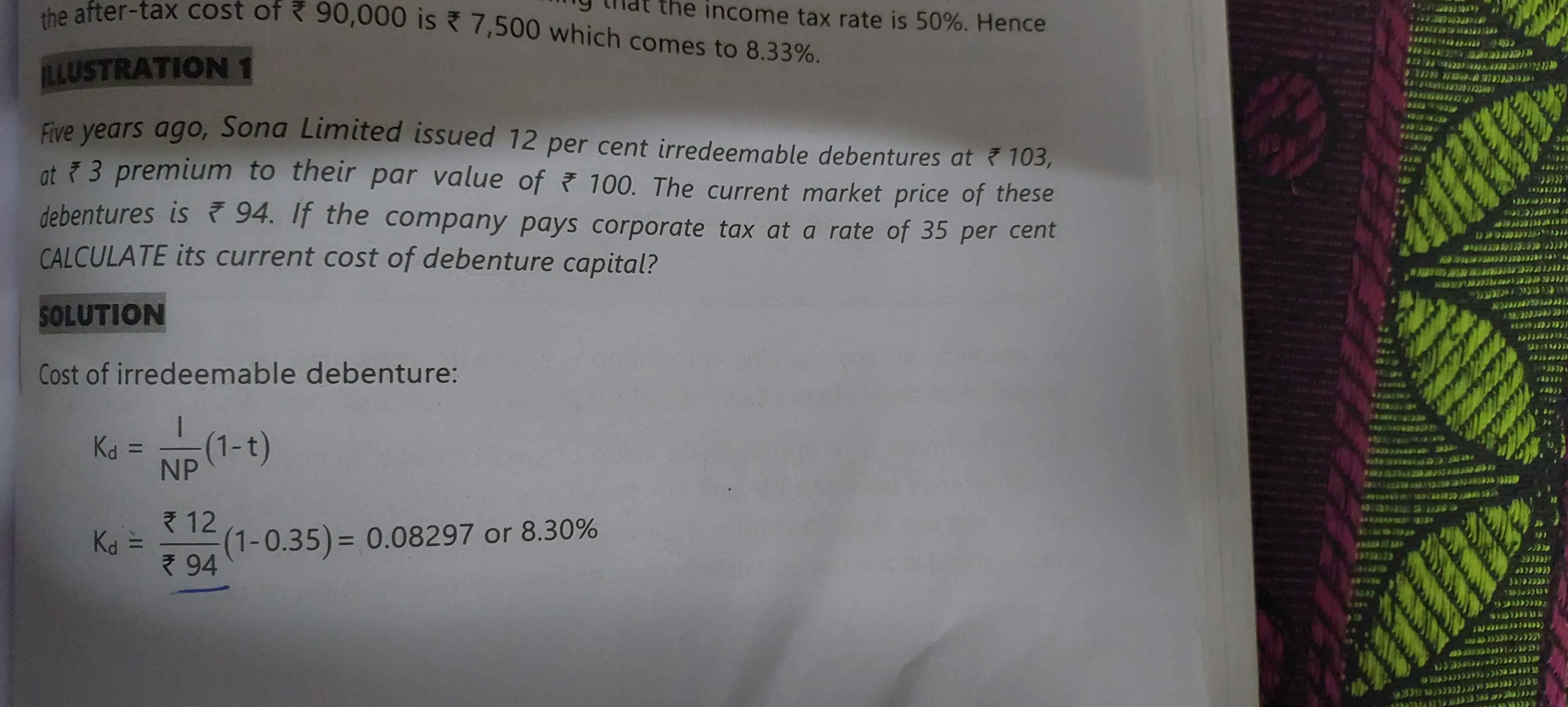

@CS Bala Aditya sir, I have recently watched the youtube video posted by 1fin regarding the doubt in cost of capital chapter. There I got literally confused. There in the explanation,what should be taken as net proceeds in case of debentures/pref.shares,you explained that always prefer issue price - floatation cost. Also a note has been given, that if the term "issued at par/ premium/ discount " is [not] given , assume issued at market price, then net proceeds = MP - floatation cost. My doubt is in illustration 1 of ICAI material itself. In that issue price = 103( given) Current market price= 94 ( given) Then why we have not considered issue price? And another doubt is ,the note given in the video mentions....(' issued at par/ premium/ discount 'is not given), whether this line to be considered as it is or somewhat it can be rearranged. I.e., in the illustration 1 Sona ltd.( issued )12% irredeemable debentures( @ )₹103,at ₹3 (premium).... note the (). Kindly help me to clear the doubt sir

Answers (2)

1. Net proceeds what you will get if you sell the shares in the market immediately and ofcourse you'll have to deduct flotation cost as it's deducted from the proceeds. Net proceeds is market value minus flotation cost incase of irredeemable security. 2. Incase of redeemable security realisable value is the value you'll get when you sell the securities immediately at market price (less flotation cost) and net proceeds is the amount you'll get when the securities are redeemed. Therefore it can be at par or premium

Whatever I had mentioned in the video, I have also referred the illustrations. The case there is about either new company or fresh issue of securities. Here, in the question you had posted, the company had raised the debentures in the past and it is trying to evaluate the cost based on today’s market scenario and hence the market price is considered.